Using Superannuation for Dental Work: Can You Pay for Veneers, Implants or Aligners?

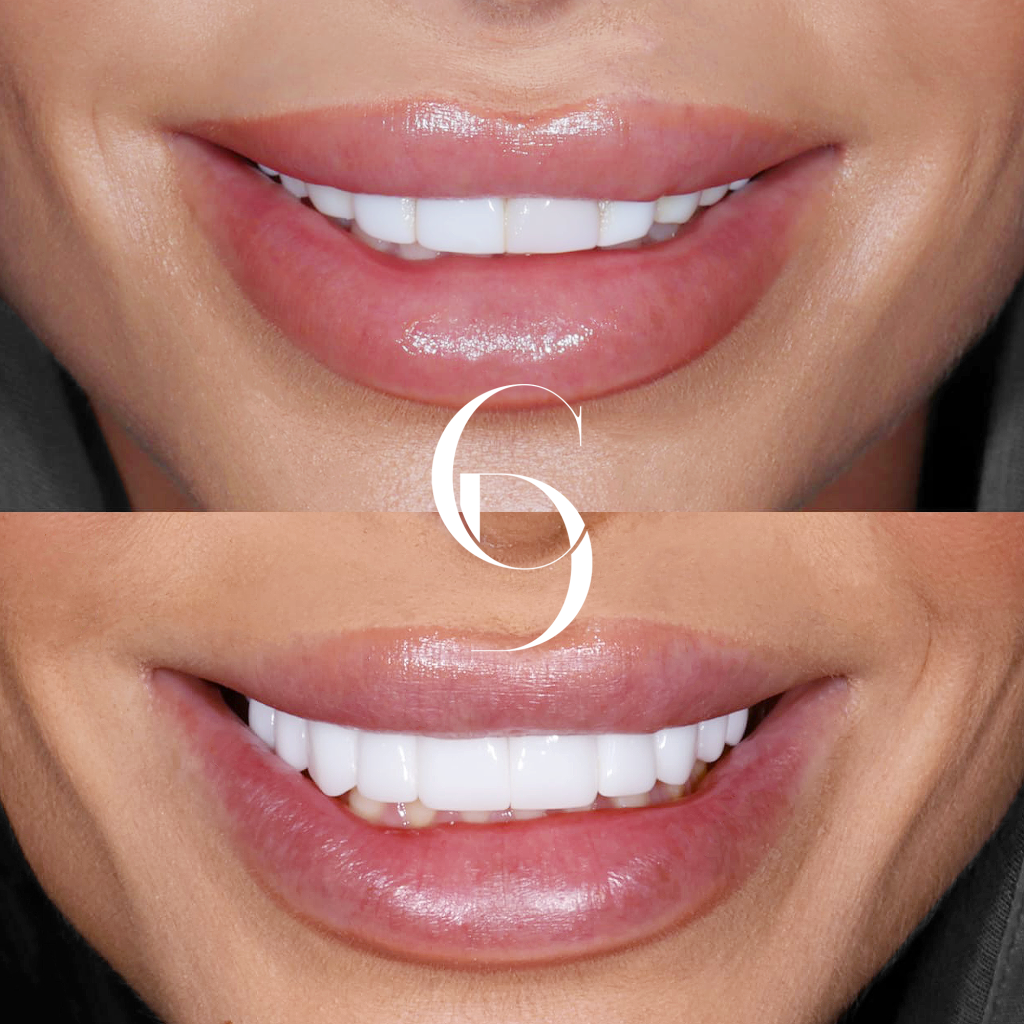

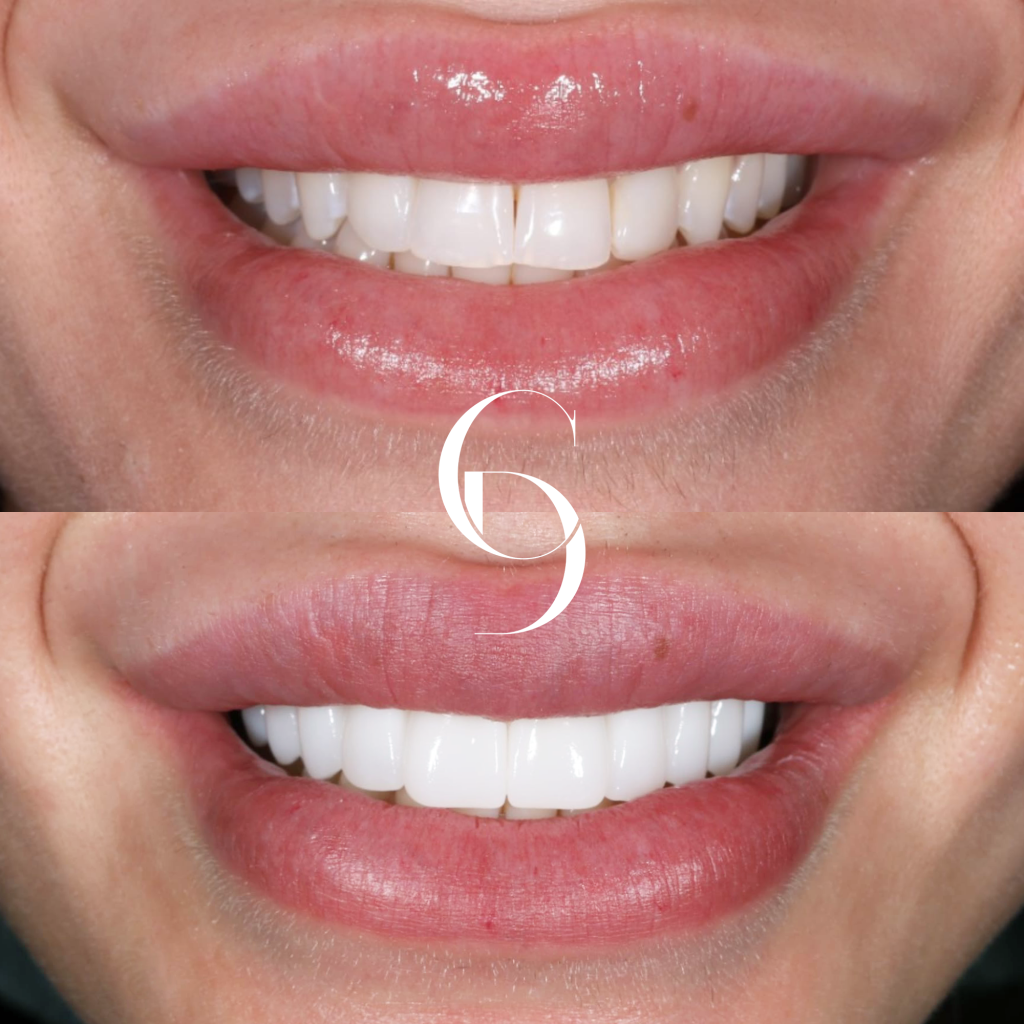

Considering cosmetic dental work but worried about the cost? Treatments like veneers, implants and clear aligners can be expensive, especially if you’re not covered by private health insurance.

Here’s the good news: you can use your super for dental—in some cases. If your treatment is considered medically necessary, you may be eligible to access your superannuation early to help cover out-of-pocket costs.

Here’s what that actually means, and how the process works.

Can I Use My Super to Pay for Dental Implants?

So, can you use super for dental? Yes—it’s one of the most common reasons people apply for early release.

Implants replace missing teeth, restore bite function, and improve jaw health. Left untreated, missing teeth can cause pain, bone loss, and other complications, so this type of treatment is often considered medically necessary.

To qualify, you’ll need:

- A treatment plan from your dentist.

- A medical letter confirming the need.

- Evidence that you can’t afford the treatment without your super.

Not sure if you’re eligible? Our cosmetic dentists in Sydney can help guide you through the process and paperwork.

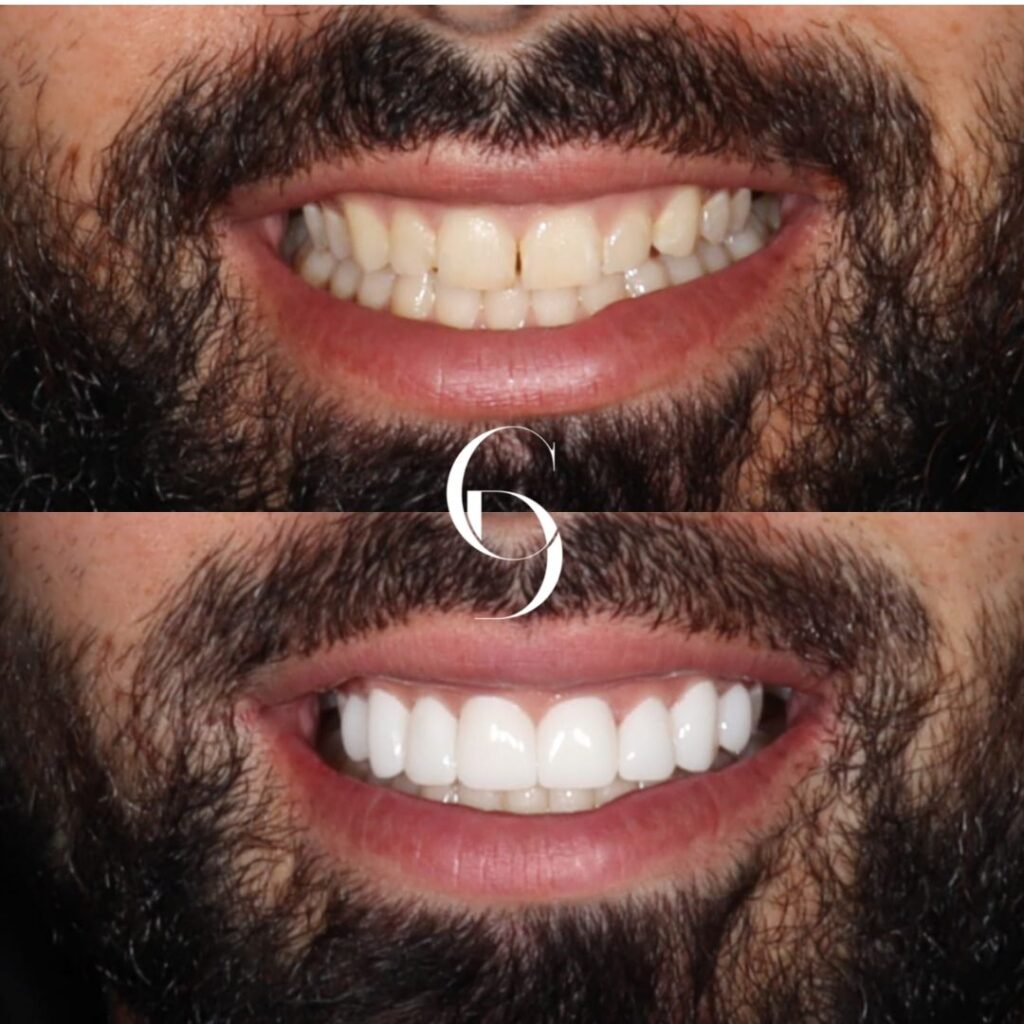

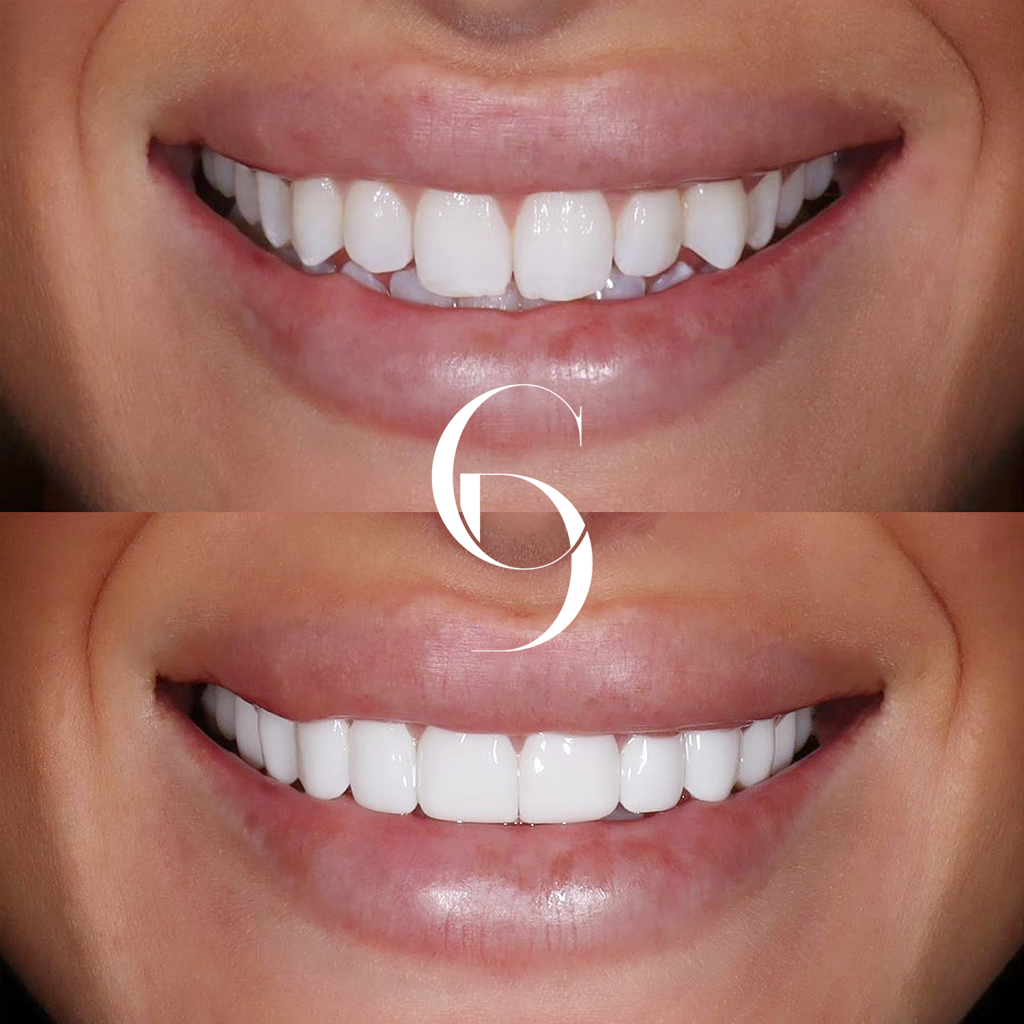

Can You Use Super for Veneers?

Are veneers covered by super? Sometimes—but not always.

Veneers are often considered cosmetic. But if they’re part of a broader treatment plan—say, following injury or major enamel wear—they might be eligible. The key is showing that they’re necessary for your health or wellbeing, not just aesthetics.

If you’re considering porcelain teeth for a full smile restoration, speak to us about how to structure the treatment plan to align with ATO guidelines.

What’s the Application Process Like?

If you’re ready to apply, here’s a simplified version of what to expect:

- Get your documents together: This includes a quote from your dentist, a treatment plan, and a letter from a medical professional supporting your claim.

- Apply through MyGov or one of our external service providers: Log into your MyGov account and follow the steps under “compassionate release of super.” Make sure you select the correct reason (medical/dental).

- Wait for ATO review: If approved, the ATO will notify your super fund, who will then release the funds directly to you or the clinic.

It can take a few weeks, so get started early—especially if you’re in pain or have a time-sensitive treatment coming up.

Why Use Superannuation for Dental?

Dental treatment is essential, but it’s not cheap. Here’s why some people choose to access their super:

- You don’t need to take out a loan or go through credit checks.

- You can use it for yourself or eligible family members.

- It lets you access high-quality care at a private clinic.

- You can get treatment sooner, without waiting months or years.

A Few Things to Consider First

Before you apply, keep in mind:

- You’re using money meant for retirement, so weigh the long-term impact.

- Not all super funds allow early release, so check with yours first.

- Cosmetic-only treatments aren’t usually covered.

Still unsure? The Cosmetique Dental team are familiar with early-release applications, can walk you through the options, and help you make the strongest case.

Using Your Super to Pay for Dental

So, can you use your super to pay for dental? If the treatment is essential and you’re struggling to afford it, then yes—there’s a good chance you can.

From dental implants to orthodontics (and, in some cases, veneers), superannuation access can help make important dental work more achievable. Just ensure your dentist provides clear documentation and you’re ready with the right supporting evidence.

If you’re unsure where to start, our team can talk you through your options and help you get your application right the first time.